A “strictly private and confidential” letter, exclusively seen by the mouseinthecourt, shows that the city regulator was aware, some 32-months before the FCA shut the platform down, that then co-director Tim Alastair Gordon, 44, had “borrowed” £350k from the company client account.

Please donate to the Cheese Fund to support crowd-funded journalism of the P2P sector.

Reporting by Daniel Cloake.

Lendy was a so-called peer-to-peer lending company which facilitated the crowd funding of loans by members of the public secured against property and other assets.

Lendy became fully authorised by the FCA in July 2018 and had some 10,500 active investors on the platform.

The company was placed into administration in May 2019 following action taken by the Financial Conduct Authority and Damian Webb, Phillip Rodney Sykes and Mark John Wilson of RSM Restructuring Advisory LLP were appointed as joint administrators.

This article is part of a series looking at the role of the FCA in the Lendy fiasco, examining what they knew and when.

£350,000

The mouseinthecourt has exclusively obtained a copy of a letter from Mr James Gallagher, a Senior Associate in the Client Assets and Resolutions Department at the FCA.

The letter, dated 13th October 2016, was addressed directly to Tim Gordon, then a co-director with Liam Brooke.

The letter confirms that the FCA held a meeting with the firm in September 2016.

In the letter Lendy is told that they have “been required to act in compliance with the Client Asset Sourcebook (‘CASS’) of the FCA’s handbook, since 1 June 2015.”

CASS governs strict rules on handling client money – ie money that isn’t the property of the company but held on behalf of its clients.

Lendy is told that following a “limited assessment” the FCA found “that the Firm’s client money arrangements do not meet these requirements.”

“Our assessment focused on areas of CASS where we have identified that there is a high risk that client money is not segregated and protected.“

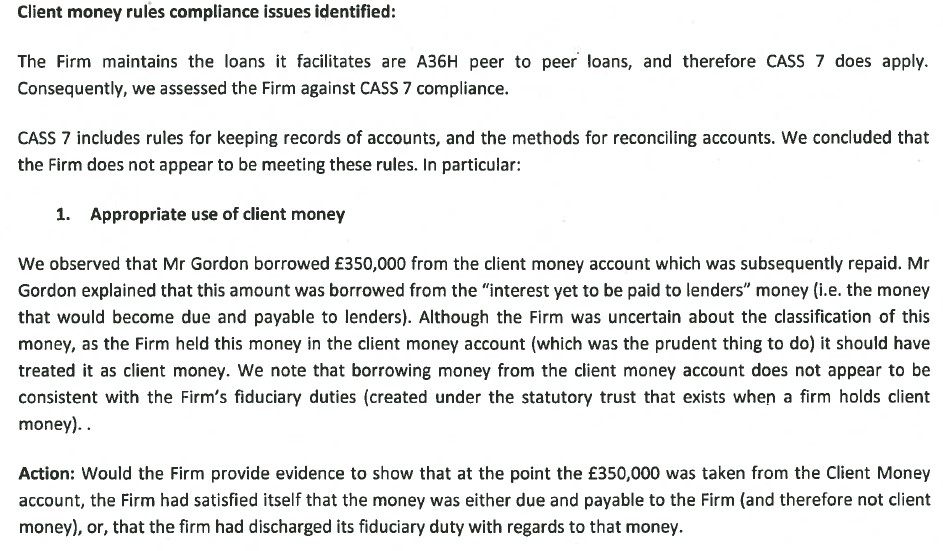

Under a bold heading entitled “Appropriate use of client money” they FCA say they have: “observed that Mr Gordon borrowed £350,000 from the client money account which was subsequently repaid.” The city regulator say that Lendy “should have treated it as client money.“

The FCA added “We note that borrowing money from the client money account does not appear to be consistent with the Firm’s fiduciary duties (created under the statutory trust that exists when a firm holds client money)“

In the response from Lendy to the FCA we’re told that “with effect from 31 October 2016, we have appointed a new employee, Robert Easterbrook, to take over the role of compliance within the Firm“.

The response letter, undated in the copy we hold, explains that Lendy “can confirm that, at the point the £350,000 was taken from the Client Money (9 February 2016), it had satisfied itself that these funds were due and payable to the Firm and therefore was not client money.“

It is said “The reason for this confirmation is that all bridging loans prior to PBL063 were conducted using the old model of non-P2P agreements.“

Apparently this meant “that any interest deducted from loan advances for these non-P2P agreement loans belonged to Lendy Ltd until the point at which they were credited monthly to lenders.” So that’s alright then.

The mouseinthecourt has not seen any legal advice to confirm or refute this assertion.

If this is correct though Mr Gordon could have borrowed quite a bit more as “the sum of interest held for 31 non-P2P agreement loans and not yet paid to investors was £3,305,631.82“

Mr Gordon resigned as a director on 26th July 2018.

We have not been able to obtain the FCA response to the denial of wrongdoing by Lendy.

The work on this site is protected by copyright laws and treaties around the world. All such rights are reserved.

You may print off one copy, and may download extracts, of any page(s) from our site for your personal use and you may draw the attention of others within your organisation to content posted on our site.

You must not modify the paper or digital copies of any materials you have printed off or downloaded in any way, and you must not use any illustrations, photographs, video or audio sequences or any graphics separately from any accompanying text.

Our status (and that of any identified contributors) as the authors of content on our site must always be acknowledged.

You must not use any part of the content on our site for commercial purposes without obtaining a licence to do so from us or our licensors.

The directors of Savings Stream, as Lendy was then know, was being advised by the dubious accountant Adam Bolger. I investors in Savings Stream / Lendy may wish to undertake their own enquiries as to the questionable conduct of this person.

LikeLike