A “confidential” letter sent from a senior associate at the Financial Conduct Authority has revealed that the city regulator was aware of an astonishing number of detailed concerns about failed peer-to-peer lending firm Lendy in June 2017.

It took almost two years after the date of this letter before the FCA finally pulled the plug on the platform. According to reports made by the joint administrators’ the members of the public who invested stand to lose up to 93% of their money in some cases.

Please donate to the Cheese Fund to support crowd-funded journalism of the P2P sector.

Reporting by Daniel Cloake.

Lendy was a so-called peer-to-peer lending company which facilitated the crowd funding of loans by members of the public secured against property and other assets.

Lendy was fully authorised by the FCA and had some 10,500 active investors on the platform.

The company was placed into administration in May 2019 following action taken by the Financial Conduct Authority and Damian Webb, Phillip Rodney Sykes and Mark John Wilson of RSM Restructuring Advisory LLP were appointed as joint administrators.

Mr Webb wrote a rather damning summing-up of how the company was run in written submissions made to the High Court in .June 2021.

It will be apparent … that Lendy was subject to serious mismanagement for a long period of time. The operations of Lendy were chaotic at the best of times, and investors’ funds were not properly protected or managed. Indeed, it is surprising that Lendy managed to survive for as long as it did. As I explain … the legal and contractual documentation relating to Lendy’s activities is also extremely confusing.

Paragraph 100 of Damian Webb’s 2nd Witness Statement

Despite the myriad of issues Lendy somehow managed to achieve full authorisation by the Financial Conduct Authority in July 2018.

Liam Brooke, the CEO and co-founder of the platform, stated in a press release that:

We’re very pleased to have been given full authorisation by the FCA. It has been a long and sometimes challenging journey, which has involved a detailed review of our processes and policies and has helped us mature into a stronger and more robust business.

Liam Brooke in a news posting on the Lendy Website (back-up link) 11/07/2018

This is a validation of our efforts to move from a young start-up to an established mainstream lender, with the ability to disrupt the banking model for the benefit of clients, and design new investment products and services.

Serious questions have been raised by the members of the public who used the Lendy platform as to how the FCA came to fully authorise the firm in July 2018 despite the extensive issues that have come to light since.

After all, the FCA’s business plan for 2016/2017 stated:

“Where we believe firms’ behaviour may pose a significant risk to consumers or the market, we work with them to raise their standards, and failing that, we prevent them from entering the market“

Lord Myners, the former City minister, is quoted in the FT as having said that the FCA’s authorisation of Lendy gave it “a sense of regulatory approval and endorsement, which encouraged people to feel they had been vetted” adding “The FCA should, in my view, have been more alert”.

An investor called Mike told us “I would estimate that I have lost in the region of £160,000 as a direct result of FCA approval and my silly belief that this meant the company was soundly run and my interests were protected. Well, we know how that worked out.”

Simon says he invested £450,000 in crowd-funded loans facilitated by Lendy. He says he “saw the FCA as a rubber stamp that the business was being run honestly and correctly, and thus was assured it wasn’t a scam. I would not have invested anything without the FCA involvement. All this turned out to be rubbish, hence we are where we are!”

A different investor, also called Mike, told us “My wife and I had about £20k each invested in the Lendy base account and we were aware of the risks of loss. However as soon as the FCA gave “full” authorisation and the Lendy Wealth product came out we thought “what could go wrong” and invested £30k each from our pension lump sums into LW. So yes, the fact that the FCA gave full authorisation was a massive factor in our decision to invest more.”

An investor called Marc, who says he had over £100,000 on the platform, told us he “placed full reliance on the FCA stamp of approval” … “The FCA badge offers a false sense of security, one which the retail clients rely on, and as such, undertake less due diligence before investing. I was one such gullible person!”

In June 2022 the mouseinthecourt exclusively reported on an employment tribunal matter involving a former FCA risk manager. The correspondence that we uncovered lead us to ask ‘Did internal politics and a culture of confusion at the FCA fail P2P investors?‘. Lisa Taylor, who runs the so-called Lendy Action Group, told us “Having read all these e-mails [deployed at the tribunal] just seem to support the fact that the FCA was asleep at the wheel“.

So was the FCA just plain ignorant at what was going on at Lendy? Apparently not.

The FCA appeared to be extremely well informed of everything that was going on at Lendy and its day to day business

Paragraph 64 of Damian Webb’s 2nd Witness Statement

The letter

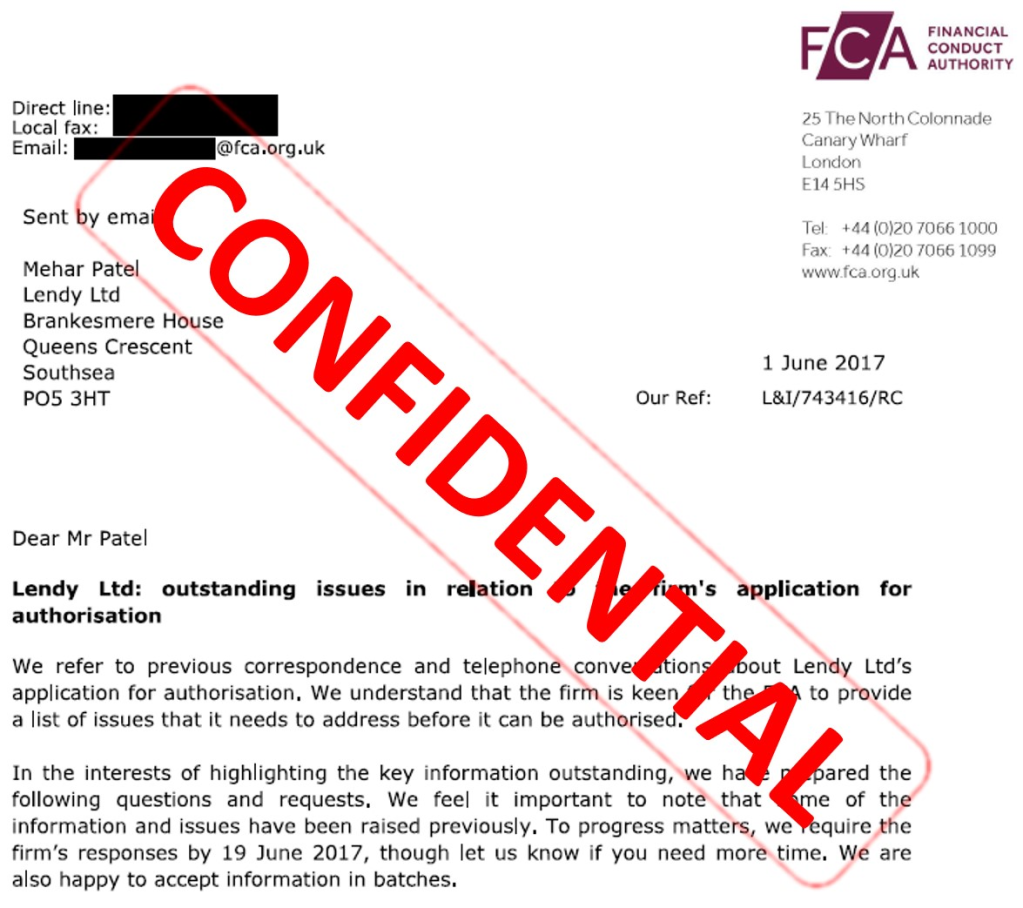

The mouseinthecourt has exclusively obtained a copy of a letter from Mr Robert Cooper, a Senior Associate in the Lending & Intermediaries Department at the FCA. The letter, dated 1st June 2017, was addressed to Lendy’s then head of legal Mr Mehar Patel.

“This letter has been prepared for regulatory purposes only and its contents should be treated as confidential” remarks Mr Cooper at the end of this 11-page-letter.

Noting “that some of the information and issues have been raised previously” the FCA identified that a number of deficiencies existed both with the loan book and the firms compliance with so-called Article 36H — the actual regulation which allowed Lendy to operate “an electronic system in relation to lending“.

Lendy applied for a full FCA licence in March 2016 so at this point the FCA would have been considering the application for 1 year and 3 months.

The date of the letter — June 2017 — is particularly significant. This was the same month that the loan book peaked at £228m. Monthly investments from investors averaged £14m.

We’ve summarised some of the key points from the letter below.

The Lendy website and financial promotions

“The FCA has considered the new Lendy website and in our view, it lacks balance. This is

because it presents the advantages of investing with the firm, but fails to prominently

disclose some of the key risks such as lack of FSCS cover.“

“The link to the full risk disclosure is also insufficiently prominent.“

Again the FCA have “previously highlighted a number of concerns in respect of the individual loan listings” but they “remain concerned that it is hard for a retail investor to make an informed decision prior to purchasing loan parts on both the primary and secondary markets.“

According to media reports some £80m had been invested on the platform in the preceding five months alone. This is a huge sum of money whilst such concerns existed.

The letter states that FCA rules “require a firm to notify a client in good time about any material change to the information in regard to the nature and risks of the investment“.

“In our email of 15 February 2017, we highlighted that until Lendy Ltd has taken steps to address the inconsistencies in the information presented on its website, the FCA will not be in a position to determine the application. In reply the firm confirmed that this work was part of an on-going review; however, it seems this has not yet concluded.“

In a commendable level of detail “whilst not exhaustive, we have some feedback on the website, and in particular, the information presented to investors prior to making a decision to lend:“

Model 1 loans

The first item identified is that:

“The firm does not make it clear that investors are lending to Lendy Ltd under all “Model 1” loans where Lendy Ltd is the borrower under the agreement

“We were advised on 15 February 2017 that “in future, it is our intention that all loans listed on the Platform will have a link such that investors will be able to immediately recognise which Business Model was relevant to the loan when it was first made available on the Platform.”

“This does not appear to have happened” conclude the FCA.

Why did this matter? Well, under the so-called ‘model 1’ the lenders would lend money to Lendy and Lendy would loan the money to a borrower.

As a result of Lendy’s insolvency these model 1 investors have now become unsecured creditors of the platform facing a significant, if not complete, shortfall.

(Those who are really interested can read why this is the case in this High Court judgment starting at paragraph 54)

The FCA had “identified two examples that demonstrate our concern“

“PBL027 states that the borrower is Reform Energy PLC. Whilst this may be the borrower that Lendy Ltd has lent to, the investor is lending to Lendy Ltd.“

Another loan, PBL037, was …

“currently in default, but if investing in this loan, the investor is lending money to Lendy Ltd. No information is provided about the borrower on the listing aside from a statement that says “Our borrower needs the funds in order to purchase this piece of strategic land which is within the grounds of their exist (sic)”.“

Performance of the loans

The FCA identified that “it is hard for an investor to accurately gauge the performance of a loan. Whilst the firm provides a start date and a drawdown date, there is often conflicting information as to the term of a loan, when and why an extension has been granted and what the payment history is.“

Again two examples are given:

“PBL057 was drawn down on 21 September 2015 and the listing says “we will be paid back within 12 months”. However, at present the listing states the loan has in excess of 100 days remaining on the term. It is also unclear why this loan was extended and what additional assessment was undertaken to ensure that this was appropriate in the circumstances.“

“DFL002 was drawn down on 22 March 2016 and is shown as have a loan term remaining in excess of 10 days. But there is no indication on the listing as to the actual term of this loan, or the values and dates of each tranche.“

Quality of updates

The FCA noted that “the firm has taken steps to address concerns surrounding the quality of updates. However, we are concerned that these are not sufficiently clear or prominent, and it is hard for an investor to determine when these were posted with vague timescales for any update over 1 year old.“

The example of PBL037 is again given:

“PBL037 has a number of updates but it is unclear when each was posted, for example, two are listed as ‘1 Year Ago’ two saying ‘Repayment expected shortly’ the other stating ‘Expecting repayment within a month…’

“Whilst these are old updates, we would question why actual dates have not been assigned to updates.“

Retained interest

One advantage to users of the Lendy platform was that investors would receive a return, in the form of interest, every month.

However, this interest was actually financed by other investors.

In simple terms, and with the omission of various fees and other expenses, a borrower looking for a £1m loan would actually result in a loan of say £1.2m appearing on the platform.

Members of the public would collectively crowdfund the £1.2m. The borrower would receive the £1m and Lendy would place the remainder, £200k, in a bank account under its control.

Every month Lendy would pay some of that £200k back to the investors in the form of interest.

This practice continued for another 2 years until the platform collapsed.

In the letter the FCA reveal that “we cannot see how the firm’s requirement for retail investors to lend the retained interest, is acting in their best interests“.

“It is also our view that the firm’s website does not clearly articulate to investors how retained interest works and its promotions do not comply with the requirements of [our rules]. The fact that monthly interest payments are a return of investor’s own capital is a key omission.“

“We are also concerned that the practice of using retained interest could potentially serve to mask the true performance of the loan and lead investors to sell out of the loan prior to the end of the term without bearing any credit risk.

“This in itself creates additional risks for certain investors who may not understand how retained interest works and purchase these loans on the secondary market. These investors could be assuming all of the credit risk relating to these loans without actually being aware of the true nature of their investment.“

Sometimes, the money set aside for these interest payments would run out and Lendy would pay the investors out of its own pocket.

The FCA say they “are concerned that the firm’s decision to ‘service’ interest payments from its own balance sheet will fall outside of the requirements of [Article 36H]” adding “we are concerned that this practice is unsustainable and could lead to risks to the firm’s own capital position.“

Credit Underwriting and Debt Recovery Processes

The FCA notes “that the firm has a large number of loans that are overdue or in default (under the revised default policy, which the FCA has not been provided with). Despite this, the firm still enables retail investors to sell and purchase loans that are either late or in default on the secondary market.”

The FCA say their rules “requires the firm to provide investors with a general description of the nature and risk of that designated investment

“The FCA considers it misleading [to] promote investment opportunities on loans that have experienced payment difficulty, on the basis of creditworthiness assessments that may no longer be accurate or relevant to the investment opportunity.“

Again, two examples are given:

“PBL074 is currently listed on the platform as a defaulted loan, which is 322 days late. New investors are still able to invest over £25,000 in this loan. The firm promotes the security on this loan to be worth £460,000 with an LTV of 70%.

“However, this valuation was carried out 18 months ago. It is also noted from updates that although the borrower had previously received offer that would “clear our debt”, it is likely to be sold at auction. Given this position, it is unclear how accurate the promoted LTV of 70% is.”

“PBL027 is late by 166 days, having already been extended on a number of occasions. At present, over £35,000 is available on the secondary market and the loan is promoted on the basis of a 56% LTV.

“Given that the valuation was carried out in February 2013, and the loan has been extended far beyond the original term, we are concerned that the information contained on the listing is misleading to investors. The exit strategy also does not seem to reflect to the information posted on the ‘recent updates’.“

The city regulator has also, it seems, carried out research on the asset, worryingly finding that:

“It has also come to light that the site was subject to an arson attack in April 2016 and pictures posted on various news sites show the building that is pictured on the Lendy website listing was destroyed.“

PBL027 (or Property Bridging Loan number 27) was a crowdfunded loan of £2.9m understood to have been collective financed by 1,700 people. It ultimately ended up being a complete write-off.

Provision Fund

The intention of the provision fund was to always hold a sum of money, equivalent to 2% of the total value of the loan book at any time, to be a discretionary fund to compensate investors in the event of any losses.

The FCA said their “view [was] that investors cannot accurately gauge the likely protection it might afford and the suggestion is that there is 2% of the total live loan amount, which may not be correct.

“Irrespective of the firm’s declarations that the Provision Fund “does not guarantee loans or provide insurance against loss”, the fact remains that the risk of not being paid out by the Provision Fund is concealed, as there is no figure promoted on the firm’s website.“

The FCA conclude that “on this basis, we consider the firm’s promotion of the Provision Fund does not meet the ‘clear, fair and not misleading’ requirements in [the rules]“.

Approved Persons

We’re told that the FCA is “still awaiting an application from an Approved Person who will hold [various regulatory including a compliance officer and Money Laundering Reporting] control functions. This has been outstanding for some time and these are essential control functions for the firm.“

Compliance with Article 36H

We’re told that the FCA have “considered the firm’s responses to our feedback on its compliance” with Article 36H. But that “at present, the firm is still non-compliant with the permission it is applying for and urgent steps needs to be taken to revise contractual documentation to comply“.

The letter explains that the FCA used the borrower enquiry form on the Lendy website and were surprised when they received a phone call back.

“It is the FCA’s view that there can be no human element involved in the operation and there must be some kind of automation in the interactions between the participants. The electronic system operated by the firm must facilitate persons becoming both lender and borrower. In other words, the system must bring both parties to a loan agreement together.

“As such, we are not satisfied that the firm is currently compliant with A36H(1).“

Residential Properties

PBL144 was a £315k loan with almost 800 investors. The loan page on the website states that “the loan will be secured against a Buy-to-Let (BTL) property [in Surrey].”

The FCA seem to have investigated this loan with a remarkable level of detail having examined photos of a kitchen bin and conducted a background check on the borrower.

“Having considered the listing for PBL144, it appears this may be an owner-occupied residential property.

“The valuation report states that the property did appear to be owner occupied and that they were told the property was vacant. The photos at the end of the report show the kitchen which appears to shows signs or current habitation, eg, food is visible and there is a waste bin with liner. “

The mouseinthecourt has obtained a copy of the valuation report which shows the picture.

“The applicant is also an individual and who is listed on the voters roll at the same postcode as the property in question.“

Questions the FCA asked Lendy included “On what basis has the firm determined that this is not a regulated mortgage contract and what due diligence was carried out to verify the property was BTL?” and “Why did the firm not check that repayment was on track until just over a month ago?“

Next Steps

The FCA asked for a response to the letter by June 19th 2017.

“Once the FCA has considered the firm’s response, if our concerns have not been addressed, it is likely that we will invite the firm to [the FCA office] to discuss the application.” It is not known if this occurred.

The mouseinthecourt understands that the FCA visited the Lendy office in early October 2017 which was conducted to help the FCA “better understand the way the firm operates and to discuss systems and controls.“

What was revealed during that visit will be discussed in out next report.

The mouseinthecourt approached the FCA for comment and they did not get back to us.

The work on this site is protected by copyright laws and treaties around the world. All such rights are reserved.

You may print off one copy, and may download extracts, of any page(s) from our site for your personal use and you may draw the attention of others within your organisation to content posted on our site.

You must not modify the paper or digital copies of any materials you have printed off or downloaded in any way, and you must not use any illustrations, photographs, video or audio sequences or any graphics separately from any accompanying text.

Our status (and that of any identified contributors) as the authors of content on our site must always be acknowledged.

You must not use any part of the content on our site for commercial purposes without obtaining a licence to do so from us or our licensors.

One thought on “Lendy: Confidential 2017 FCA report reveals catalogue of concerns”