The Joint Administrators’ of the failed peer-to-peer finance firm Lendy Ltd have in the last few days filed a breach of contract claim against Lee Baron Limited, a specialist property management company based in London, the mouseinthecourt can exclusively reveal.

Lendy litigation is a lot like a London bus as this site broke the news that a different claim had been filed just a few days ago in related to the £4.5m Hampton Court loan saga.

In this claim the underlying loans on the platform are understood to total £7m collectively crowdfunded by some 5,000 members of the public.

Lendy collapsed in May 2019 amid significant financial and regulatory difficulties.

The Homer Row loan, circa £7.45m*, was advanced in March 2017. Following a sale of the property at auction just £1.17m was returned to investors in May 2021 after legal fees and expenses.

The Mutton Row loan, circa £711k, was advanced in February 2017. In this loan just £23,509 – some 3.2% – was returned to investors in May 2021 after legal fees and expenses.

Whether this litigation could directly benefit the investors remains to be seen. It is understood that the issue of exactly who would receive any damages – ie the platform or the investors – is still a live issue. See our coverage of “Lendy Directions – The Background” to explore some of issues resolved following the platforms collapse.

Homer Row prior to demolition in May 2019 (Credit: Daniel Cloake)

The bombshell that rocked the P2P world

Anyone remotely familiar with litigation in the world of peer-to-peer lending will have heard of the genre defining judgment of Mr Justice Zacaroli in the case of Lederer v Allsop.

Arising directly out of claims made by persons connected to these properties the High Court found that borrowers were not only entitled to know the identity of those who had invested but were able to commence litigation against them for damages.

This principle, which could be said to be a failure of the Financial Services and Markets Act to protect consumers, has crept into litigation at other P2P companies including Assetz, Unbolted and indeed other Lendy Loans.

The claims against Lendy and the members of the public were ultimately prevented from proceeding by the court after the claimants failed to satisfy certain financial requirements.

The Lee Baron claim

The defendant in the claim is Lee Baron Limited: “a specialist property management firm of 150 dedicated professionals headquartered in London and operating nationwide“

It is understood that Lee Baron prepared the valuation reports for both Homer Row and Mutton Row.

Written documents setting out the particulars of this claim have yet to be made publicly available.

The burden of proof in any breach of contract claim rests solely upon the claimant. At this early stage absolutely no inference of wrongdoing should be assumed on the part of the defendant.

This site will keep an eye open for any developments in the litigation. You can support our crowdfunded journalism by donating to the Cheese Fund.

We have approached the Joint Administrators and Lee Baron Limited for comment.

*Correction (04/02/2023): An earlier version of this post showed the loan value as £6.2m. This figure, as displayed on the Lendy website, had been reduced by the subsequent repayment.

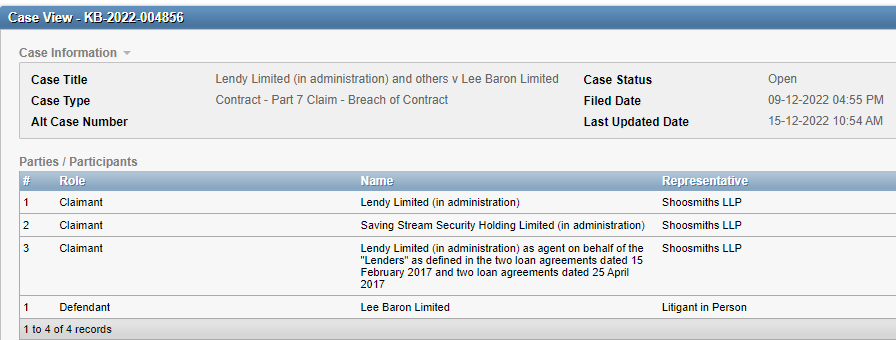

Case details

The High Court, Kings Bench Division

Case Number: KB-2022-004856

Claimants

1) Lendy Limited (in administration)

2) Saving Stream Security Holding Limited (in administration)

3) Lendy Limited (in administration) as agent on behalf of the “Lenders” as defined in the two loan agreements dated 15 February 2017 and two loan agreements dated 25 April 2017

The claimants solicitor is Shoosmiths LLP

Defendant

Lee Baron Limited

Solicitor details are not currently available

One thought on “Lendy launches breach of contract claim in £7m Homer & Mutton Row loans fiasco”