Investors in the failed peer-to-peer lending company FundingSecure are raising money for legal advice after a disgruntled company creditor raised the prospect of joining them to a High Court claim.

Update: September 2022 – Nigel Cairns, Transparency Task Force member, responds. Click to jump

FundingSecure was a company which facilitated the crowdfunding of loans by members of the public “many of whom were ordinary consumers investing their personal savings”.

The firm was fully authorised by the FCA but collapsed in October 2019 amid significant financial and regulatory problems.

Following their appointment, it became clear to the Administrators that there was a lack of clarity regarding the operation of the Platform and the Company’s client account.

Written submissions made to the High Court in the March 2021 FundingSecure directions hearing

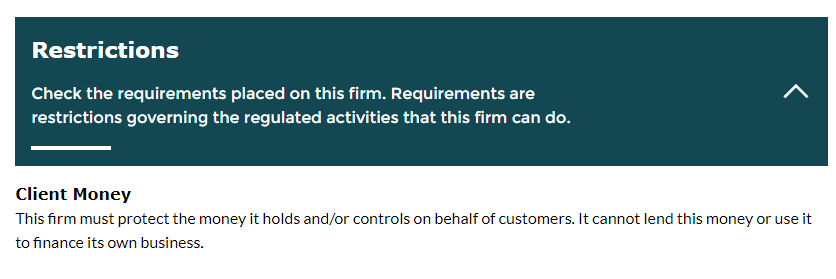

A ‘client account’ is a segregated ring-fenced bank account which holds customer funds separately from company money. Firms which look after client money are subject to strict FCA rules known as CASS.

Issues with the client account

Issues with the FundingSecure client account had plagued the company for several years. In June 2019 a world wide freezing injunction was obtained over former director Richard Luxmore, 58, of Reading. FundingSecure had claimed, among other things, that:

“[Richard Luxmore] procured the payment of monies from [FundingSecure’s] client account to [a third party] in the absence of (1) a Loan Entry; (2) any security; and (3) any loan agreement with the recipient.“

Mr Luxmore admitted that at least £2.2m of payments had been “made from [FundingSecure’s] client account.” Mr Luxmore sought to defend this conduct describing it as “an established practice of the business“.

The company replied in no uncertain terms saying Mr Luxmore had “no legitimate basis to lend client monies to any borrower without that client (i.e. the lender’s) consent. The conduct which is admitted by RL is fraudulent.“

It is understood that the litigation between FundingSecure and Mr Luxmore was settled, by means of a confidential order, in November 2020.

The hole is filled in

The exact details are unclear but it appears that part of the £2.5m hole was filled in by a £1.5m loan from Rajinder Kumar, 56. A High Court judgment described how Mr Kumar went on to “became both a director and the controlling shareholder of the Company“.

It was said that prior to making the loan, in Autumn 2018, Mr Kumar became “aware that [FundingSecure] was subject to an investigation by the FCA that arose when it came to light that the Company had been rolling over loans using funding from the Company’s client account.“

JC Starr

It now appears that FundingSecure also obtained circa £500,000 from a BVI Registered company called ‘JC Starr Holdings Limited’. According to draft legal documents, seen by the mouseinthecourt, it is said the £0.5m was paid into the companies client account on 12th April 2019.

The money was said to have been lent “for the sole and exclusive purpose” of underwriting loans and it is claimed that this created a so-called Quistclose Trust, named after the defendant in a leading 1968 court case.

Instead, the document claims that the Administrators of FundingSecure had revealed the money had been used inter alia:

“to repay investors whose investment returns had been applied towards the operational costs of the Defendant (in other words, to repay losses created by the historic misapplication of client account monies)“

The Claim

The proposed claim is at an early stage, and the exact mechanics of it are beyond the scope of this humble blogger to explain.

What can be deduced however is that JC Starr Holdings Limited wants the money back and is prepared to target the investors on the platform to do so.

The Investors

It has been reported that at the date of administration the platform had some 3,500 investors, who collectively had lent over £80m.

Some of those have joined the so-called FundingSecure Action Group. An update posted to the group, unverified by the mouseinthecourt, says:

“Following enquires, it has been ascertained that the claim is not limited to £320k and a significant proportion of FundingSecure lenders accounts are possibly at risk.“

An investor, Mr Ivan Murray-Smith, 35, from Norfolk has set up a fund raising effort on the Gofundme platform.

The purpose of this fundraiser is to pay for legal advice regarding the pending Quistclose Trust litigation, and in particular to advise Funding Secure investors as to the best course of action.

Introduction to the £3,708 funding raising effort

We spoke to Mr Murray-Smith and he explained he had set up the Gofundme page “because there was a clear need to take some sort of action and nobody else had stepped up.”

“Most comments from investors were just confused questions and puzzled remarks… given the large number of people with money at stake and the short time available, paying counsel for advice seemed by far the best solution given that the cost, divided amongst all investors, would be trivial.“

“The overwhelming response has been very positive. Most people seem happy to pay something between £5 and £20 to find out what their legal position is and at the time of writing 158 people have contributed an average of £16.78 each. If we get another 63 donations of this amount we will meet our funding target.“

The FCA

FundingSecure became fully authorised by the FCA in March 2017.

The FCA have had a chequered history with the P2P sector, with some accusing them of being ‘asleep at the wheel’. This site exclusively reported on “a comprehensive catalogue of missed warnings about the so-called peer-to-peer lending sector after disclosure in a recent case at the Employment Tribunal” back in June 2022.

The FCA has three statutory objectives, which include ‘securing an appropriate degree of protection for consumers‘ and ‘preserving the integrity of the UK’s financial market‘.

The latter reason was cited at the trial of the FCA v London Property Investments (U.K) Limited & Others. Barrister Mark Fell QC, representing the FCA, told the High Court that the FCA had intervened because “the consumers don’t have access to the Financial Ombudsman Service, the Financial Services Compensation Scheme, they don’t have the benefit of the protections that the authorisation process provides.”

In preparation for a hearing involving Lendy, a different P2P company, “the Financial Conduct Authority (the “FCA”) instructed Leading Counsel to attend the first Case Management Conference on 23 September 2020 and considered the possibility of being actively involved in the Applications.“

Given the risk to risk to retail investors we approached the Financial Conduct Authority and asked:

- Is the FCA aware of this proposed claim from JC Starr?

- Does the FCA intend to provide support or assistance to the lenders?

- Does the FCA intend to represent the lenders interests if the litigation continues?

- Under what circumstances does the FCA intervene in Legal Proceedings?

The FCA refused to comment and gave no reasons.

Mr Murray-Smith reacted to this saying that whilst he had no expectation that the FCA would intervene, he had:

“spent virtually my entire career working in FCA regulated entities and it is a regulatory requirement for all authorised firms to be open and transparent with the regulator, which firms are ultimately accountable to. The FCA is ultimately accountable, through Parliament, to the public it serves. While it is understandable that there will be limits on what the FCA can publicly disclose (for obvious regulatory and legal reasons), refusing to engage with the press at all on a matter of some public importance appears highly hypocritical.“

The Administrators

Jonathan Avery-Gee, Edward Avery-Gee and Daniel Richardson of CG & Co were appointed Joint Administrators of FundingSecure on 23rd October 2019.

According to a statement published on the FundingSecure home page:

“As the monies in the e-wallet account are not assets of the Company, the Joint Administrators will take a neutral position in any proceedings“.

What next?

Without the tenacious approach taken by Mr Murray-Smith, investors seemingly would be left high and dry.

The GoFundMe page explains “the legal advice thus obtained will only be shared with those who are verified by the Creditors Committee as being genuine platform investors.“

This site will keep a close eye on developments going forward.

Transparency Task Force member responds

The mouseinthecourt was please to receive the following comment to the article, published with permission, from Nigel Cairns, a member of the Transparency Task Force. He says:

Re FCA article, regarding the statement:

The FCA has three statutory objectives, which include ‘securing an appropriate degree of protection for consumers‘ and ‘preserving the integrity of the UK’s financial market‘.

Below is the FSMA wording taken from the 01/04/2019 point in time.

1B The FCA’s general duties

(1)In discharging its general functions the FCA must, so far as is reasonably possible, act in a way which—

(a)is compatible with its strategic objective, and

(b)advances one or more of its operational objectives.

(2)The FCA’s strategic objective is: ensuring that the relevant markets (see section 1F) function well.

(3)The FCA’s operational objectives are—

(a)the consumer protection objective (see section 1C);

(b)the integrity objective (see section 1D);

(c)the competition objective (see section 1E).

As can be seen the FCA has four statutory objectives, comprising one ‘strategic’ and three ‘operational’ objectives. Therein lies the rub. The ‘objectives’ are hierarchical and are inherently conflicted. This distinction may appear subtle and superficial but it translates to having profound consequences

The FCA, as they have pointed out themselves, did not enact the legislation but they are entitled to interpret it as they see fit, this may explain why the FCA feels stymied in offering comment or explanation of its failure to act.

The apparent upshot of the FCA’s discordant remit has been to embed a bias (in the view of consumer groups, not City lobbyists) that has provided a level of protection to consumers considerably below the level that consumers themselves feel is appropriate.(a serious public interest issue!)

The spectacular explosion of manifest consumer harm , HBOS,GRG, LCF, Woodford, Blackmore Bond, mortgage prisoners, etc etc…. has now become a political ‘Hot Potato’ . In reaction to this the FCA is conducting a self administered ‘transformation programme’ whilst at the same time refusing to accept any culpability for levels of consumer harm. Instead it has, under Governmental instruction, introduced additional rules and guidance the new ‘Consumer Duty’ which it claims will enable it to regulate in a way that it was previously unable to do.

The great concern is that, in fact, the FCA always have had adequate rules and powers to protect consumers to a greater degree than the have. The problem is that under the ‘Objectives’ ,which remain unaltered, the FCA is compelled to favour the interests of Financial Firms over consumers and although it may have more powerful tools, its willingness to ‘act’ ,will remain trumped by its overriding strategic objective.

End

Please donate to the Cheese Fund to support crowd-funded journalism of the P2P sector.

Reporting by Daniel Cloake

You may print off one copy, and may download extracts, of any page(s) from our site for your personal use and you may draw the attention of others within your organisation to content posted on our site.

You must not modify the paper or digital copies of any materials you have printed off or downloaded in any way, and you must not use any illustrations, photographs, video or audio sequences or any graphics separately from any accompanying text.

Our status (and that of any identified contributors) as the authors of content on our site must always be acknowledged.

You must not use any part of the content on our site for commercial purposes without obtaining a licence to do so from us or our licensors.

2 thoughts on “FCA silent on client account cash grab”